Meet our Founder!

Rachael Katz

Key 2 Debt Free was founded in December 2017 by Rachael Katz, a single mother of two sons, who had just graduated with her MBA in Finance, had over $100k of student loans, a looming $1k/mo. payment that would be due soon, and no steady income or job. With no idea of what to do with this debt or how she was going to successfully manage and pay it off, Rachael did what she always does when she’s looking for the answer…. she PRAYED! She prayed for the SOLUTION that would help her with this student loan debt dilemma; and by the Grace of God, she was introduced to the federal student loan relief programs at a conference for Nursing school students and graduates.

Rachael was hired to canvas and collect information from attendees with student loans who were interested in payment relief plans and public service loan forgiveness programs. Not being a nurse and having no plans to go into a medical or public service career; Rachael didn’t believe any of these programs would work for her student loans but decided to inquire a little more with the event organizer after he spoke at the event. Rachael was educated on the different plans and programs available to all student loan borrowers who have received loans through FAFSA (Free Application for Student Aid) and was shown how to qualify and apply for the payment relief plan and forgiveness program that was best for her.

Rachael has turned this knowledge into an educational and consulting business that has successfully helped thousands of student loan borrowers take advantage of payment relief programs that have saved them thousands of dollars annually and set them on a path towards loan forgiveness and becoming debt free.

Subscribe to our Blog below and you too can hold the key to a debt free and financially secure future. https://k2df.substack.com/

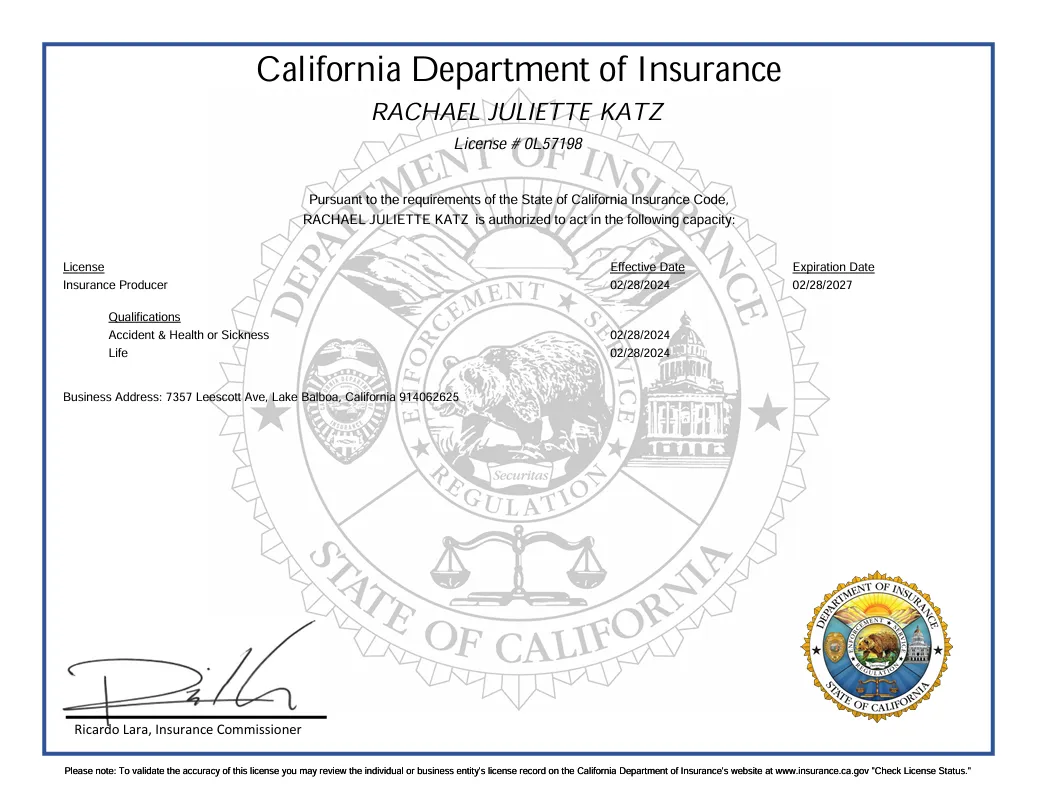

Certifications

More About Us

Who are we?

Key 2 Debt Free is a financial education and consulting company that provides services for student loan and consumer debt relief, credit improvement, income and asset protection, wealth building strategies and family legacy creation.

What do we do?

We design custom relief plans for individuals with student loans and consumer debt. Educate families and businesses about income protection and asset leveraging. Our network of vetted financial professionals have a solution to every financial concern. Whether you're looking for proven debt relief and elimination strategies, financial wellbeing tips or asset protection and wealth building tools; Key 2 Debt Free is here to help you reach the right professional for your needs.

Who do we help?

Medical

Physicians, Dentists & Dental Specialists, Veterinarians, Acupuncturist & Naturopathy, Chiropractors, Nurse & Nurse Practitioners, Occupational Therapists, Optometrists, Pharmacists, Physician Assistants/Associates, Psychologists, Speech Language Pathologists.

Non-Medical

Engineers, Financial Advisors, Lawyers, Corporate Employees/MBAs, Teachers, Public Servants, Self-Employed, Independent Contractors, Business Owners, Entrepreneurs.

Parents & Retirees

Parent PLUS Borrowers, Retired Borrowers

Contact Us Today!

Contact Us Today!

Key 2 Debt Free, LLC is a private consulting company and does not claim to be affiliated with any Federal, State, or Local Government agencies. Key 2 Debt Free, LLC is not a loan servicer or originator. Key 2 Debt Free, LLC is in no way affiliated with the Department of Education. Key 2 Debt Free, LLC consults with individuals on how to obtain federal government student loan forgiveness and/or consolidation programs by pre-qualifying, preparing, and submitting required documentation on their behalf. Individuals with student loan debt have the legal right to use an attorney or process federal student loan documentation on their own behalf without paid assistance. When you work with Key 2 Debt Free, you gain access to a nationwide network of financial professionals and specialists working to find you new products, services, and strategies for making the most of your money.

Our experienced representatives help put your financial situation in perspective, so you can prioritize your monetary goals and create a more secure financial future for yourself and your loved ones.