General FAQs

Got Questions? We've Got Answers!

How do I schedule an appointment?

You can easily schedule an appointment by going here.

What services does Key 2 Debt Free provide?

We specialize in student loan relief, credit wellness, financial consulting, and strategies to help you build wealth and protect your assets.

Do you offer personalized financial plans?

Yes! Every client receives a customized strategy based on their financial situation and goals.

Is there a cost for your services?

Some services are free, while others have a fee. We’ll discuss pricing options during your consultation.

How soon can I see results?

Results vary depending on your financial needs, but we aim to create progress as quickly as possible while ensuring long-term stability.

Student Loan Relief FAQs

Got Questions? We've Got Answers!

What are my options for reducing student loan debt?

We help with Public Service Loan Forgiveness (PSLF), Income-Driven Repayment (IDR) plans, Borrower’s Defense, and loan rehabilitation programs.

Can I qualify for student loan forgiveness?

If you work in public service, have been defrauded by your school, or qualify for an IDR plan, schedule an appointment with us to see if you are eligible.

How do I get started with student loan relief?

Book a consultation with us, and we’ll review your loan details to determine the best strategy for you.

What is loan rehabilitation for defaulted student loans?

Loan rehabilitation is a process that allows you to remove your federal student loan from default status by making a series of agreed-upon payments, restoring your loan to good standing.

How can I start the loan rehabilitation process?

To begin, book a call with our team to discuss a rehabilitation agreement, which typically involves making nine consecutive, on-time monthly payments.

What are the benefits of rehabilitating a defaulted loan?

Successfully completing rehabilitation removes the default status from your credit report, stops wage garnishments, and restores eligibility for federal student aid.

What is the Public Service Loan Forgiveness (PSLF) program?

PSLF is a federal program that forgives the remaining balance on Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

Who qualifies for PSLF?

Borrowers employed full-time by government organizations, non-profit organizations, or other qualifying public service jobs may be eligible for PSLF.

How do I apply for PSLF?

Submit the PSLF application form along with your employer's certification to the U.S. Department of Education after making the required 120 qualifying payments.

What does the court’s injunction mean if I’m enrolled in the SAVE Plan?

If you’re enrolled in the SAVE Plan, your loans are in general forbearance until loan servicers can accurately bill you, expected no earlier than September 2025. During this time, you don’t have to make payments, interest won’t accrue, but the time won’t count toward PSLF or IDR forgiveness.

How does forbearance affect my loans?

If you’re in SAVE Plan forbearance, payments are paused, interest won’t accrue, but the time won’t count toward PSLF or IDR forgiveness. If you’re in processing forbearance (up to 60 days), interest accrues, but the time does not count toward PSLF and IDR forgiveness.

Can I enroll in the SAVE Plan, another IDR plan, or consolidate my loans?

Yes, you can still apply for IBR, ICR, PAYE, and SAVE, but forgiveness under SAVE, PAYE, and ICR is currently blocked due to a court ruling. Loan servicer’s are processing IDR applications for IBR, ICR, and PAYE, while SAVE applications remain on hold with possible processing delays.

What is Total and Permanent Disability (TPD) discharge?

TPD discharge is a program that relieves you from repaying federal student loans if you are totally and permanently disabled.

How can I prove eligibility for TPD discharge?

Eligibility can be demonstrated through documentation from the U.S. Department of Veterans Affairs, the Social Security Administration, or a physician's certification.

What is the process for applying for a TPD discharge?

Complete and submit a TPD discharge application along with the required supporting documentation to the U.S. Department of Education.

What are Income-Driven Repayment (IDR) plans?

IDR plans adjust your monthly federal student loan payments based on your income and family size, potentially lowering your payments and extending your repayment term.

How do I know which IDR plan is right for me?

The best plan depends on your individual financial situation. Book a call with our team to help determine the most suitable option.

Can IDR plans lead to loan forgiveness?

Yes, after making qualifying payments for 20 or 25 years under an IDR plan, any remaining loan balance may be forgiven.

What are Parent PLUS Loans?

Parent PLUS Loans are federal loans that parents of dependent undergraduate students can use to help pay for college expenses not covered by other financial aid.

Can Parent PLUS Loans be included in Income-Driven Repayment plans?

While Parent PLUS Loans are not directly eligible for IDR plans, consolidating them into a Direct Consolidation Loan may make them eligible for the Income-Contingent Repayment (ICR) plan.

Are there forgiveness options for Parent PLUS Loans?

Yes, if the consolidated loan is repaid under the ICR plan, it may qualify for forgiveness under the Public Service Loan Forgiveness (PSLF) program after meeting the necessary requirements.

Credit Wellness FAQs

Got Questions? We've Got Answers!

What is credit wellness, and why is it important?

Credit wellness is about maintaining a healthy credit score and financial habits that increase your financial opportunities.

How can I improve my credit score?

We help with disputing inaccuracies, establishing positive credit habits, and using strategic credit-building techniques.

Can negative items be removed from my credit report?

Yes! Errors, outdated information, and certain negative marks may be disputable for removal.

How long does it take to see improvements in my credit score?

Depending on your situation, you could see changes in as little as 30-90 days.

What are some habits to maintain good credit?

Paying bills on time, keeping credit utilization low, and regularly monitoring your credit report.

Be Your Own Bank FAQs

Got Questions? We've Got Answers!

What does it mean to ‘Be Your Own Bank’?

It’s about using financial strategies like cash flow banking and infinite banking to grow and control your own money instead of relying on traditional banks.

How can I start implementing this strategy?

We guide you through setting up a properly structured policy and using it for wealth-building and financial independence.

Is this strategy only for the wealthy?

No! Anyone can use these methods to grow their wealth and create financial freedom over time.

What type of financial vehicles are used in the "Be Your Own Bank" strategy?

This strategy often utilizes properly structured whole life insurance policies with cash value, allowing you to borrow against your policy while keeping your money growing.

Can I still access my money if I use this strategy?

Yes! The key advantage is liquidity—you can borrow against your policy at any time while your funds continue to grow tax-free.

Tax, Trusts & Asset Protection FAQs

Got Questions? We've Got Answers!

Why is asset protection important?

Protecting your assets ensures your wealth is secure from lawsuits, creditors, and unexpected financial risks.

What’s the benefit of setting up a trust?

Trusts help manage wealth, reduce taxes, and ensure assets are passed on according to your wishes.

Can tax planning help me save money?

Yes! Strategic tax planning can minimize your liabilities and help you retain more of your earnings legally.

How can I legally reduce my tax burden?

By utilizing tax planning strategies such as deductions, credits, retirement contributions, and business structuring, you can significantly lower your taxable income.

What types of assets can be protected with a trust?

Trusts can protect real estate, investments, business assets, and even personal property from lawsuits, creditors, and excessive taxation.

More About Us

Who are we?

Key 2 Debt Free is a financial education and consulting company that provides services for student loan and consumer debt relief, credit improvement, income and asset protection, wealth building strategies and family legacy creation.

What do we do?

We design custom relief plans for individuals with student loans and consumer debt. Educate families and businesses about income protection and asset leveraging. Our network of vetted financial professionals have a solution to every financial concern. Whether you're looking for proven debt relief and elimination strategies, financial wellbeing tips or asset protection and wealth building tools; Key 2 Debt Free is here to help you reach the right professional for your needs.

Who do we help?

Medical

Physicians, Dentists & Dental Specialists, Veterinarians, Acupuncturist & Naturopathy, Chiropractors, Nurse & Nurse Practitioners, Occupational Therapists, Optometrists, Pharmacists, Physician Assistants/Associates, Psychologists, Speech Language Pathologists.

Non-Medical

Engineers, Financial Advisors, Lawyers, Corporate Employees/MBAs, Teachers, Public Servants, Self-Employed, Independent Contractors, Business Owners, Entrepreneurs.

Parents & Retirees

Parent PLUS Borrowers, Retired Borrowers

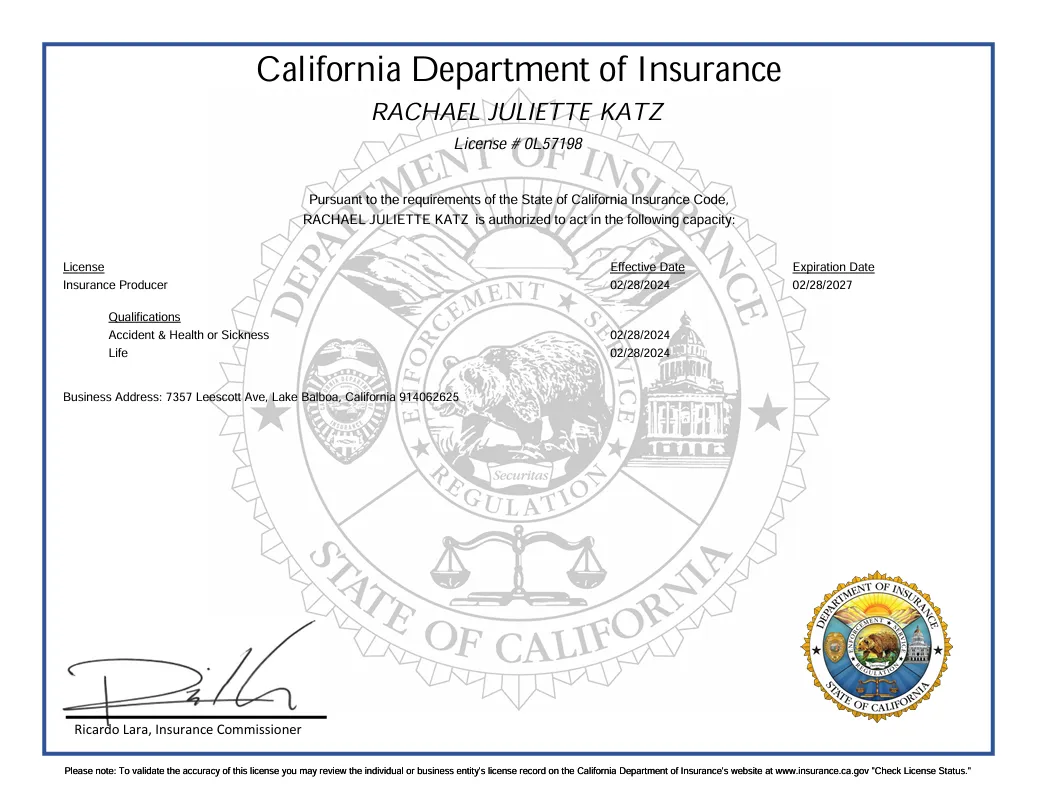

Certifications

Stay Ahead

Stay Ahead

Contact Us Today!

Certifications

Contact Us Today!

Key 2 Debt Free, LLC is a private consulting company and does not claim to be affiliated with any Federal, State, or Local Government agencies. Key 2 Debt Free, LLC is not a loan servicer or originator. Key 2 Debt Free, LLC is in no way affiliated with the Department of Education. Key 2 Debt Free, LLC consults with individuals on how to obtain federal government student loan forgiveness and/or consolidation programs by pre-qualifying, preparing, and submitting required documentation on their behalf. Individuals with student loan debt have the legal right to use an attorney or process federal student loan documentation on their own behalf without paid assistance. When you work with Key 2 Debt Free, you gain access to a nationwide network of financial professionals and specialists working to find you new products, services, and strategies for making the most of your money.

Our experienced representatives help put your financial situation in perspective, so you can prioritize your monetary goals and create a more secure financial future for yourself and your loved ones.